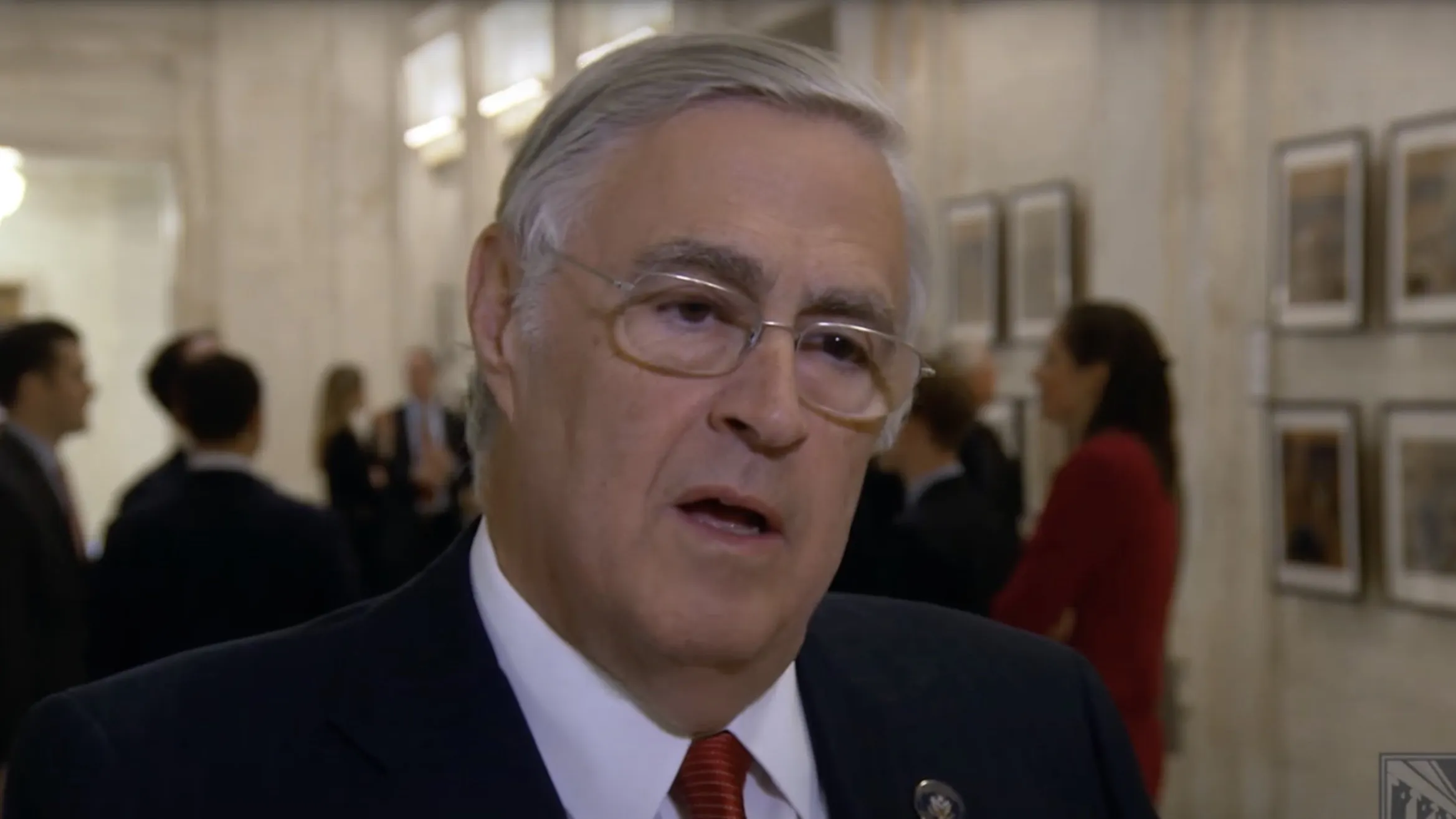

U.S. District Judge Lewis Kaplan shielded the jury on Monday from an excerpt of “Going Infinite,” a new Michael Lewis book about FTX founder Sam Bankman-Fried. Kaplan sided with an objection from the prosecution calling a conversation included in Lewis’ “letter to the jury” prejudicial hearsay.

“There is a conversation described in Michael Lewis' book that is sourced to the defendant,” U.S. Assistant Attorney Danielle Sassoon explained. “We consider [it] a false exculpatory and inadmissible hearsay.”

But the jury will never know what the judge didn’t want them to hear. That’s by design. Kaplan made the call during a sidebar discussion, just outside earshot of the nine women and three men who will soon decide Bankman-Fried’s fate.

If convicted of all seven fraud, conspiracy, and money laundering charges, he could face up to 115 years in prison. He’s pleaded not guilty.

Bankman-Fried is accused of pilfering billions of dollars of customer funds from his now-bankrupt exchange, FTX, through his defunct trading firm Alameda Research. At the same time, he is accused of lying to Alameda’s lenders and FTX’s customers and investors.

Lewis’ book contains a dialogue between Sam Bankman-Fried and Nishad Singh, the former head of engineering at FTX, who pleaded guilty to crimes associated with its collapse and has agreed to cooperate with investigators. It takes place after FTX’s swift implosion last November.

In the section lead defense attorney Mark Cohen wanted to share in court, Singh was asking Bankman-Fried what he should tell Zane Tackett, FTX’s then-head of institutional sales. “I don’t think we did anything wrong,” Bankman-Fried reportedly said, to which Singh responded, “That’s not good enough.”

Sassoon’s objection came before Bankman-Fried’s lawyer could recant the chat. She requested a sidebar meeting because she had a hunch that Cohen’s questions were about to guide Bankman-Fried’s fading memory to the topic.

Typically, statements made by a defendant who testifies at trial aren’t considered hearsay, Daniel C. Silva, a former assistant U.S. attorney and shareholder at Buchalter, told Decrypt. However, because the conversation wasn’t offered “to rebut an express or implied charge,” it wasn’t allowed under the court’s rules, he said.

“In this instance, SBF was offering [that] this was his then-existing mental state of mind,” Silva said. However, Silva said that Kaplan’s ruling suggests he “agreed with the U.S. Attorney's Office—that there was something a little bit more reflective, considered, and, in truth, manufactured” about Bankman-Fried’s remarks.

The Big Faux

Lewis’ recent tome on Bankman-Fried didn’t get its day in court on Monday. But Sassoon shined a spotlight on “Number Go Up,” a new book by the Bloomberg News reporter Zeke Faux, as she tried to force Bankman-Fried into a verbal corner on the witness stand.

At one point, Sassoon approached Bankman-Fried and handed him the book. Throughout her examination, she would return to Faux’s text to jog Bankman-Fried’s memory—to no avail. For example, Sassoon instructed the one-time CEO to turn to page 226 after he said he couldn’t recall telling Faux about the risks associated with Alameda’s move to repay lenders.

Sassoon referenced Faux’s book several other times on Monday. And its exposure compared to “Going Infinite” was noted by Matthew Goldstein of The New York Times—an observation that eventually spread to Crypto Twitter.

I gasped pic.twitter.com/UVvmbfDehb

— Max Abelson (@maxabelson) October 30, 2023

During cross-examination, Sassoon seized on other interviews Bankman-Fried gave in the wake of FTX’s wipeout, including statements he made to George Stephanopoulos on Good Morning America and Andrew Ross Sorkin from The New York Times.

“I think you said you wanted to get out there and tell what you knew?” Sassoon asked.

“Mm-hmm,” Bankman-Fried responded.

While Bankman-Fried once tapped journalists to elevate his crypto empire—and explain its eventual collapse—he appeared less confident toward the press's ability to capture his words on the witness stand. Bankman-Fried said, “I disagreed with basically every article written about me” after FTX fell apart.